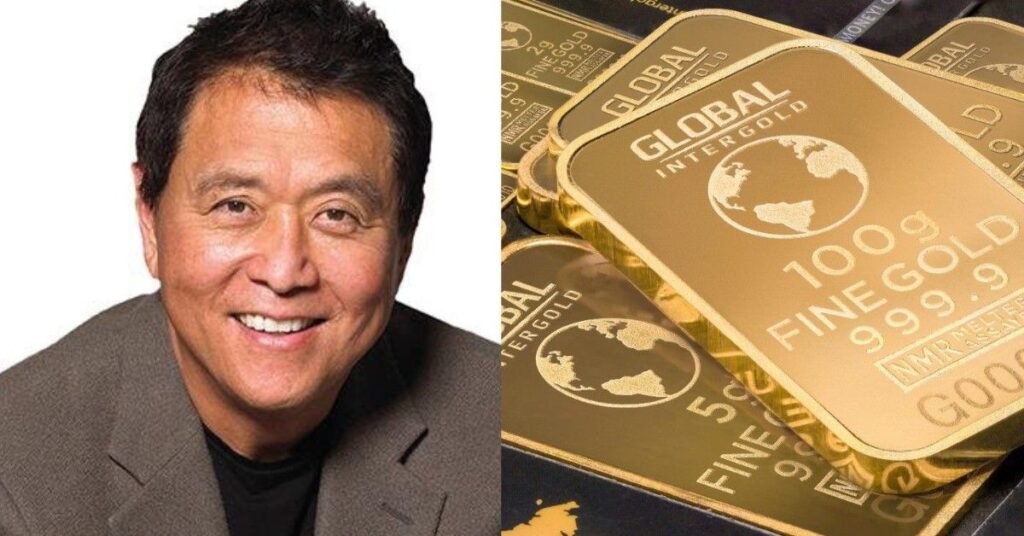

Gold prices have recently soared to unprecedented levels, with current rates in India hovering around ₹90,000 per 10 grams. Amid this surge, some analysts predict a significant downturn, potentially bringing prices down to ₹56,000 per 10 grams—a nearly 40% decline. Let’s delve into the factors that could drive such a substantial decrease.

Analyst Predictions: A Potential 40% Decline

John Mills, an analyst at Morningstar, forecasts that gold prices could plummet from the current $3,080 per ounce to approximately $1,820 per ounce in the coming years. This projection translates to a 38% drop, which would correspondingly affect Indian markets, bringing prices down to around ₹55,000 per 10 grams.

Factors Contributing to the Anticipated Price Drop

- Increased Supply: Elevated gold prices have incentivized mining activities, leading to a surge in gold production. This increased supply could exert downward pressure on prices.

- Diminished Demand: Central banks, which have been significant purchasers of gold, may reduce their acquisitions. Surveys indicate that 71% of central banks plan to either decrease their gold reserves or maintain current levels, potentially leading to decreased demand.

- Market Saturation: The gold sector has experienced a flurry of mergers and acquisitions, with a 32% increase in 2024. Such consolidation often signals a market peak, suggesting a possible forthcoming correction.

Contrasting Views: Predictions of Price Increases

In contrast to the bearish outlook, several financial institutions anticipate a rise in gold prices:

- Bank of America: Projects gold prices reaching $3,500 per ounce within the next two years, driven by sustained central bank purchases and geopolitical uncertainties.

- Goldman Sachs: Revised its end-2025 forecast to $3,300 per ounce, citing stronger-than-expected demand from exchange-traded funds and central banks.

Current Market Dynamics

As of April 8, 2025, gold prices have experienced fluctuations. After reaching a record high of $3,167.57 per ounce, prices saw a slight decline of 0.03%, attributed to investors liquidating assets to cover losses in other markets. Despite this dip, analysts maintain a positive outlook, emphasizing gold’s role as a safe-haven asset amid ongoing geopolitical tensions and economic uncertainties.

Conclusion

The future trajectory of gold prices remains a topic of debate among experts. While some predict a significant decline due to increased supply and reduced demand, others foresee continued price appreciation driven by geopolitical factors and central bank policies. Investors should stay informed and consider multiple perspectives when making decisions in the volatile gold market.