Rich Dad Poor Dad author Robert Kiyosaki explains why most people stay poor—claiming they break two fundamental laws of money: Gresham’s Law and Metcalfe’s Law.

Renowned financial educator and author of Rich Dad Poor Dad, Robert Kiyosaki, has once again sparked debate with his recent tweet highlighting what he calls the “two most important laws of money.” According to Kiyosaki, most people remain poor because they violate these laws — Gresham’s Law and Metcalfe’s Law.

Gresham’s Law: Bad Money Drives Out Good

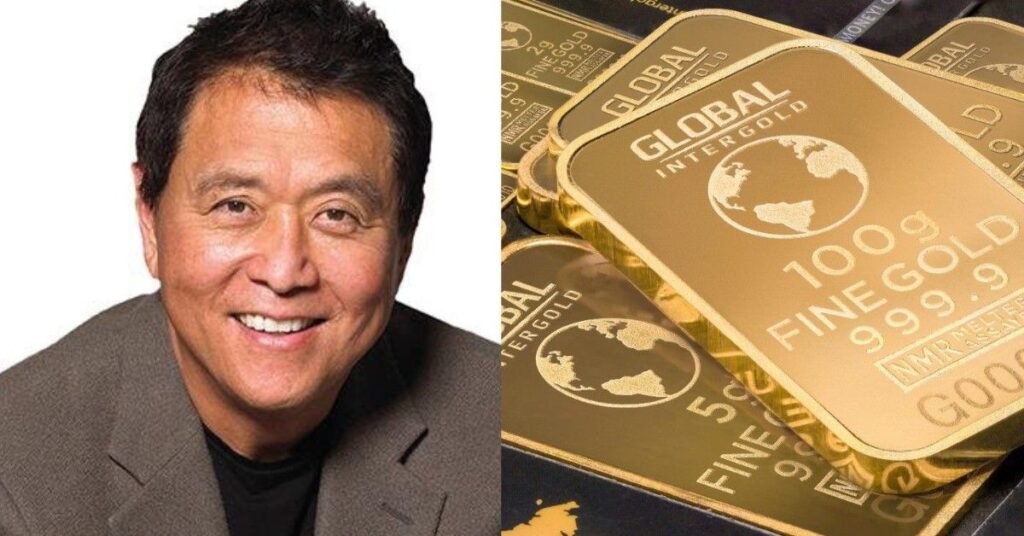

Kiyosaki references Gresham’s Law, a principle from monetary economics which states that “when bad money enters a system, good money goes into hiding.” He links this idea to the current state of global currencies, claiming that fiat money such as the U.S. dollar is “fake” and being saved by those unaware of the law’s implications.

“In 2025, poor people are working for and saving fake money,” Kiyosaki wrote, emphasizing that savers are now “losers” because they are holding onto depreciating currencies. Instead, he advocates storing wealth in assets he considers real money — gold, silver, and Bitcoin — which he believes preserve purchasing power over time.

Metcalfe’s Law: The Power of Networks

The second law Kiyosaki highlights is Metcalfe’s Law, which states that the value of a network increases exponentially with the number of users. He argues that wealth is built through participation in strong, scalable networks — not isolated operations.

To illustrate, he compares McDonald’s to small family-run burger joints, and FedEx to a one-truck delivery business. In his view, the success of McDonald’s and FedEx is rooted in their robust network structures. He applies this same logic to the cryptocurrency market.

“I invest in Bitcoin because it is a network,” Kiyosaki tweeted. “Most cryptos are not.” This distinction explains why he avoids “shit coins” — his term for cryptocurrencies without meaningful adoption or underlying infrastructure.

Following the Laws to Build Wealth

Kiyosaki’s message is clear: if you want to build wealth, you must operate within systems that align with these fundamental laws. “Do you obey the laws?” he challenges his followers.

He also echoes a quote by Michael Saylor, a fellow Bitcoin advocate and prominent voice in the digital asset space: “Only invest in things a rich person will buy from you.”

Rejecting Fiat, Embracing Sound Money

Kiyosaki concludes his tweet by reaffirming his personal investment strategy: avoid saving U.S. dollars, and instead accumulate gold, silver, and Bitcoin. These assets, in his view, comply with both Gresham’s and Metcalfe’s laws — making them more suitable stores of value and vehicles for wealth accumulation.