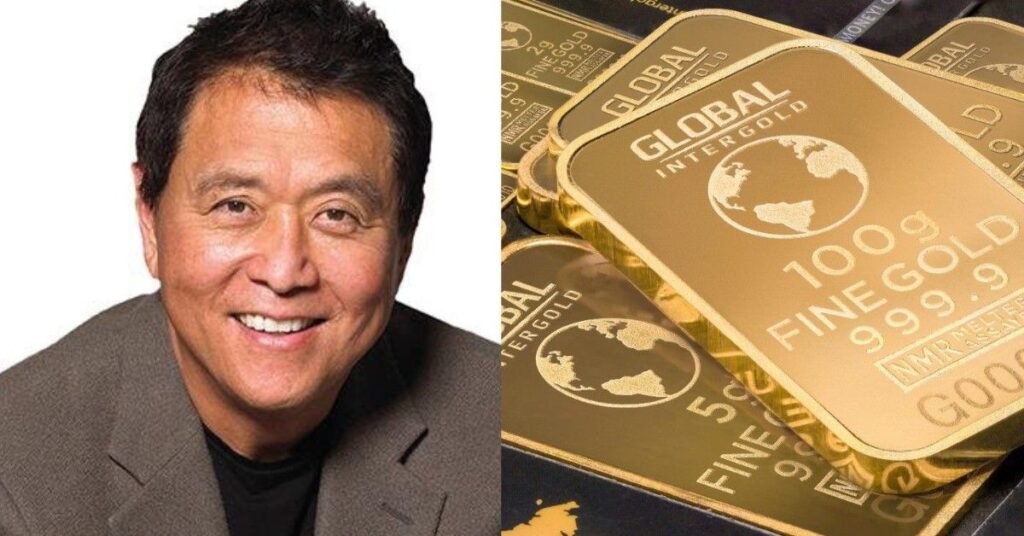

Robert Kiyosaki warns of a financial collapse following a failed US bond auction, predicts soaring gold, silver, and Bitcoin prices, and criticizes government bonds as unsafe investments amid fears of hyperinflation.

Robert Kiyosaki, the author of the best-selling book Rich Dad, Poor Dad, has issued a dire warning about the state of the U.S. financial system through a series of recent social media posts. He painted a bleak picture of what he calls the financial system’s collapse, sparked by a failed U.S. Treasury bond auction and growing mistrust in traditional investments like government bonds.

In his latest tweet, Kiyosaki described the situation as a party where no one showed up, “The Fed held an auction for US Bonds and no one showed up. So the Fed quietly bought $50 billion of its own fake money with fake money. The party is over. Hyperinflation is here. Millions, young and old, to be wiped out financially.”

THE END is HERE:

— Robert Kiyosaki (@theRealKiyosaki) May 21, 2025

WHAT if you threw a party and no one showed up?

That is what happened yesterday.

The Fed held an auction for US Bonds and no one showed up.

So the Fed quietly bought $50 billion of its own fake money with fake money.

The party is over. Hyperinflation is…

He warned that the Federal Reserve’s move to purchase bonds itself signals the end of normal market functioning and the beginning of hyperinflation. Kiyosaki sees this as a financial endgame, affecting millions who will face severe economic consequences.

Despite the grim outlook, he offered a bullish prediction for alternative assets, stating, “Gold will go to $25,000. Silver to $70. Bitcoin to $500k to $1 million.”

He also urged readers to explore The Big Print, a new book by investor Larry Lepard that examines the consequences of expansive monetary policies and runaway inflation.

This tweet follows Kiyosaki’s equally strong message from the day before, where he criticized the widespread belief that U.S. government bonds are safe investments. He called this idea a “Big F’n Lie,” accusing financial planners of misleading their clients into trusting what he calls “toilet paper.” “Only a chump would believe that BS,” he said.

BFL: Big F’n Lie: “Bonds are safe.”

— Robert Kiyosaki (@theRealKiyosaki) May 20, 2025

For years financial planners have been lying to their “chumps” a.k.a. “clients” that “US bonds are safe.”

Only a chump would believe that BS.

Lesson: Nothing is safe if there is “counter party-risk.”

Stupid example of counter party…

Kiyosaki emphasized the dangers of counterparty risk—the risk that the other party in a financial contract may default—arguing that no investment is truly safe if this risk exists. He made a provocative comparison: trusting U.S. bonds is like leaving your children with a convicted criminal simply because the parole officer said they had served their time.

Kiyosaki traces the problem back to 1971, when the U.S. abandoned the gold standard, leading to decades of what he terms “printing fake fiat money.” He accuses the Federal Reserve and Treasury of covering up fiscal mismanagement and corruption, which he calls “The Swamp.” He also praised figures like Donald Trump and Elon Musk for exposing this system, including through the rise of cryptocurrencies like Dogecoin.

Highlighting Moody’s recent downgrade of U.S. debt and the fact that central banks are selling U.S. bonds to buy gold, Kiyosaki claims these are clear signs of a loss of faith in the U.S. financial system. He warned investors to avoid paper assets such as ETFs, calling them “more expensive toilet paper.” Instead, he recommends holding physical gold, silver, and Bitcoin as the only real stores of value.

Closing his message with a somber note, Kiyosaki wrote, “THE END I have been warning the world about is HERE. May God have mercy on our souls.”